In the second chart I showed the numbers using Bruce Greenwald's formula which suggests that Apple Inc.'s growth capex is much higher than it is estimated in the first chart.

Animated Chart with Scroll

Source: Apple Inc.'s 10-K and Author's Calculation

How to Understand If a Company needs Growth Capex to Increase Revenue

For manufacturing companies that produce physical goods, capacity utilization is a good indicator of whether the company needs additional capacity to increase its revenue. For instance, 50% utilization of a company’s production capacity in the recent year suggests that there is still a lot of room for the company to increase its revenue if demand increases, as there is unutilized capacity. No immediate growth capex is needed for that company.

However, if a company is running at, let’s say, 95% utilization of production capacity, it has little room to increase its revenue with the current production capacity. It needs growth capex to increase its revenue from its current level.

But What About the Companies That Have Scalability?

There are some companies that have the perks of scalability, meaning they have much higher revenue earning potential from the same capital base compared to traditional manufacturing companies.

Compare a cement-producing company with a tech company that sells software. A cement-producing company’s revenue-earning potential is limited by its production capacity, whereas a software-producing company is not bound by such limitations. You can think of it like this: A software-producing company’s capacity to produce revenue-generating products is more dependent on its intellectual caliber and creativity than on the number of offices and computers it has.

Also, when it produces a product and sells it to customers, it has very little marginal cost for each dollar revenue. A software company’s revenue-earning potential can't be gauged by its production facility as clearly as it can with manufacturing companies that produce physical goods.

Capex is required by a software-producing company as well, but the type of capex is different from traditional sense. You can compare the capex trend among companies that belong to the same industry to further investigate.

Capex for a software producing company can be different from capex for physical goods manufacturing companies. For example, investment in intangibles can be a big portion of a software producing company which should be regarded as capex. I discuss the case for intangibles in the later section of this article.

Capex requirement for generating growth in business also indicates whether a business is capital light or capital intensive. For instance from the above example, software producing companies are usually capital light businesses whereas, cement producing companies are capital intensive businesses. For generating additional one dollar sales, a capital light business will require less capex compared to capital intensive businesses.

How to Find the Capex Amount of a Company from Its Financial Statements

There are two ways to derive capex.

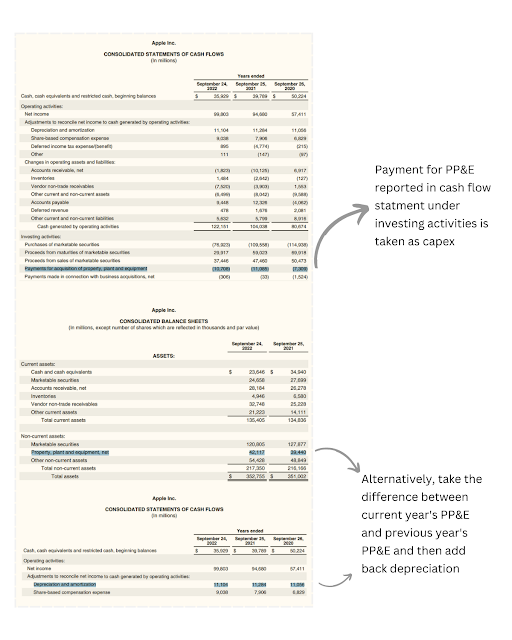

Go to the balance sheet of a company. Find their recently concluded year-end PP&E and the previous year-end PP&E and find the difference (recent year-end PP&E - prior year-end PP&E). Then add the depreciation amount reported during the recently concluded year, and you will find the capex made in that year. You may ask why we are adding depreciation. Well, depreciation is a non-cash item, and no cash outflow really occurs as a result of depreciation, even though it reduces the PP&E amount. Hence, we add back depreciation for adjustment.

You can also find capex in the cash flow statement of a company. In the cash flow statement under investing activities, you will generally find a line item called purchase of PP&E, which suggests the stated period’s cash outflow for purchasing PP&E. You can also take this amount as capex of the company during that period.

Limitations

The depreciation = maintenance capex assumption can be misleading if the assessment of depreciation is either overstated or understated. For instance, if a company overestimates the useful life of a machinery, it will understate depreciation each year and the machinery will become obsolete before it becomes fully depreciated in the book. Hence, the maintenance capex for that particular machinery should be much higher than the capex. The opposite can also happen where maintenance capex is lower than depreciation.

Also machinery or equipment can become obsolete much earlier than anticipated due to technological advancement or some other reasons. Here, maintenance capex can become higher than depreciation.

Also, effect of inflation and deflation can understate maintenance capex. Maintenance capex can increase/decrease due to inflation/deflation while depreciation generally has no effect of inflation/deflation which makes the depreciation number an imperfect proxy for maintenance capex.

Bruce Greenwald’s formula for breaking down capex can be one solution to address this problem. But it has limitations as well.

His formula doesn’t consider investment in intangibles as capex which is becoming more and more significant in driving a business’ growth. While considering capex as a source of growth and sustainability of the business, we also need to consider the investment in intangibles apart from investment in tangible assets.

We Need to Pay Attention to Intangibles

Global economy is shifting from one relying on tangible assets (e.g. plant, machineries, buildings) to one that is based on Intangible assets (e.g. goodwill, patent, trademarks, R&D etc.). In the traditional capex analysis, investment in intangibles are often ignored. We need to look at investment in intangibles the same way as we do for investment in tangible assets.

Companies invest in intangibles both for growth and maintenance. For instance, spending on research and development (R&D) is a form of investment in intangibles. Many academicians and practitioners assume that spending on R&D is all about growth, but there is evidence that a meaningful percentage of R&D spending, especially for large digital technology companies, is in fact necessary just to maintain current operations.

There are other issues that need to be considered while analyzing investments in intangibles. In most cases, intangibles arise after a merger or acquisition. But in the later period, most of the expenditures to maintain or grow those intangible assets are reported in operating expenses instead of reporting it as an investment. So, an analyst can infer from the operating expenses what are the expenses that are related to maintenance and growth of intangible assets and consider them as a form of capex.

How to Interpret Capex

First, you need to determine what is a regular capex amount for the business you are looking into given the size of the business. You can gauge the number by looking at the business’ history and by comparing with other industry players. Then you need to breakdown the capex into growth and maintenance. Growth capex increases the potential for revenue and profit increase. Maintenance capex helps the business remain at the current level in terms of sales.

If you find a company that regularly makes growth capex and the business has profitable business opportunities (can be gauged by gross margin, return on investment), the company has more possibility for value addition. However, if you find the same capex trend but the business has very few profitable business opportunities, the company has low possibility for value addition and high possibility for value destruction.

You can also assess whether a company has higher possibility of gaining market share in the respective industry by looking at its capex trend comparing with industry players’ capex trend. If the subject company is making higher capex compared to other industry players’ and the industry has growth opportunities, then the subject company has higher possibility of gaining market share and vice versa. However, you need to look at the purpose of capex. If the capex is done for diversifying the business, then it’s a different industry. Then you need to analyze the industry the business is diversifying into to further asses the impact of capex.

Impact of Capex on Free Cash Flow

From the free cash flow to firm formula, FCFF = Cash flow from operations - Capital Expenditures, we understand that higher the capex, lower the free cash flow and vice versa. Hence, if you anticipate that the growth in capex will be lower than the growth in cash flow operations, the business will have positive growth in free cash flow. If currently the growth capex is higher than maintenance capex, we can infer that there is higher potential for free cash flow growth compared to the combination of high maintenance capex and low growth capex.

Conclusion

Capex is an important indicator to understand a business’ growth potential and sustainability. As an analyst, investor and business owner, you need to be able to differentiate between maintenance capex and growth capex. Also, you need to consider whether you need to adjust your approach in determining the classification of capex. For instance, you need to check whether depreciation is an appropriate proxy for calculating maintenance capex. Bruce Greenwald’s formula can be one alternative and there can be other ways to figure it out. Also, you need to incorporate investment in intangibles in your capex analysis as the significance of intangibles are increasing.